Premium Plus Guide

Enjoy cashback, travel perks, FX fee discounts and more

Here’s an overview of all Premium Plus’ features and benefits so you can get the most out of your card. You can scroll on or use these quick links to jump to a specific section:

• More control over cash flow

• Protection that comes with your card

• Benefits for you to enjoy

• Ways to manage your account

• Security features

• Credit limit requests and support

• Important things you need to know.

More control over your cash flow

Have power over the payments coming in and out of your business.

Six months interest-free purchases*

Benefit from up to 56 days’ interest-free credit when your six months are up. T&Cs apply†

Cashback on your business spend

Get 0.5% cashback on all eligible business spend, up to £400 per year. T&Cs applyΔ

Set your payments on repeat

Use your card for recurring payments like utility bills or subscriptions.

Save 2% on foreign exchange fees

Along with travel insurance to keep you covered on the road.

Your card’s got you covered

All the protection that's included as standard. T&Cs apply.**

-

Purchase protection**

• Cover for theft or damage

• Cover for items you buy as gifts

• No need to register items you buy

• Up to £6,000 per claim (£2,500 for any one item)

• Multiple claims allowed in any 12 months, up to £/€10,000 aggregate value. -

Cardholder misuse**

• Cover for fraudulent card use by employees, including contract and temporary staff

• Up to £15,000 per cardholder and £1,000,000 per account holder, per year.

-

Travel insurance**

You’ll be covered overseas if you pay your trip in full with your Premium Plus credit card.

Travel insurance for you

• Emergency medical expenses up to £2m worldwide

• Personal liability up to £2m

• Personal accident up to £350,000

• Hospital benefit of £55 for each 24 hours

• Personal belongings and money up to £3,000.Travel insurance for your business

• Legal expenses up to £25,000

• Cancellation up to £6,000

• Missed departure up to £1,000

• Travel delay up to £300

• Business document replacement up to £1,000

• Lost or stolen money replacement up to the value of £750

• Emergency personnel replacement up to £1,000.

**Insurance T&Cs apply. If you opt out of insurance, you won’t be eligible for the insurance benefits and won’t be able to make a claim. If you’d like to opt back in, please call us on 0800 008 008 and we’d be happy to help. We’re open 24 hours a day, seven days a week.

Benefits for you to enjoy

See what perks you get, just for being a Barclaycard business cardholder.

Handpicked perks, only for our business cardholders

We want to reward you for doing what’s best for your business. That’s why, as a Barclaycard business card customer, you have access to handpicked offers and perks from our selected partners.

T&Cs apply.

Treat your team with tickets to live shows and events

Save on tickets to the UK’s hottest live shows, festivals and our headline events all year round. Plus, you (and your team) can get:

• Presale access for selected festivals and events

• Refreshing discounts

• Exclusive event perks.

Ways you can manage your account

Keep on top of your business spend in a way that suits you.

Online servicing

You can do most of your account admin through online servicing. It’s available on desktop, tablet or mobile.

If you’re an administrator, you’ve got even more tools at your fingertips:

• Add or remove cardholders (it’s free to do)

• Make payments and set up Direct Debits

• Download transaction reports.

MyControls

If you’re an account administrator with access to online servicing, you can use MyControls to:

• Temporarily freeze misplaced cards

• Set business profiles for purchases

• Add card permissions for employee travel

• Turn on ATM cash withdrawals

• Allow online or in-store purchases

• Set spending profiles for each card.

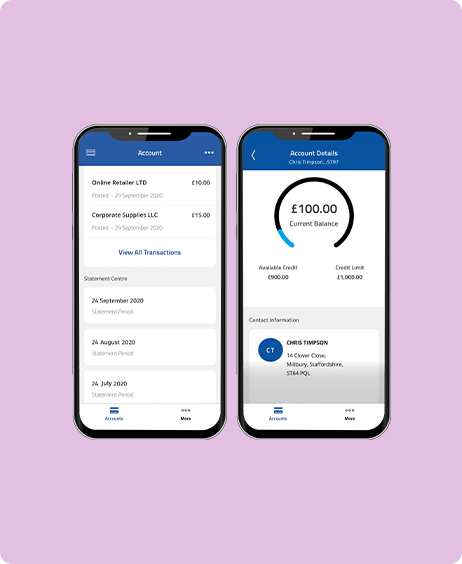

Barclaycard for Business app††

You can use our dedicated app to manage your spending on the go.

• View your PIN, instantly

• Authenticate your online payments

• View your account balance, credit limit, transactions, and statements

• Report and replace lost or stolen cards, freeze and unfreeze your card.

Don’t have the app yet? You can download it from the App Store or Google Play.

Stay protected with enhanced security

Our safety measures are here to keep you and your payments protected.

-

Automated text service

• Quickly alerts you if there’s a transaction we’re not sure about

• Messages include transaction details and what to do next

• Reminds you to keep your contact details up to date. -

Help minimise the risk of fraud

Chip and PIN

• When buying online, use the three digits on the back of your card for extra security

• Change your PIN at most UK ATMs.Contactless

• To enable contactless payments, you must first make a transaction using Chip and PIN.

Apple Pay

• Card information is secure because it isn’t stored on your device or shared.

-

PIN locking

• If the PIN is entered incorrectly three times in a row, your card will be locked

• To unlock, reset your PIN at most UK ATMs. -

Two-factor authentication

When logging in to your account or buying things online, you’ll sometimes need to prove your identity.

You’ll need:

• Something only you know, like a password or PIN

Something only you have, like your phone or card reader.If you think someone may have used your card online without your permission, contact us straightaway and we’ll check it out.

We’re here to help

We’re only ever a click or a call away if and when you need us.

Credit limit changes

You can find your credit limit in the letter that came with your card, on our app or by logging in to your account.

You can request an increase after six months – or lower your limit any time.

Answers to your questions

Head to our home for business card customers for answers to the most common questions we get asked.

Or call 0800 008 008, any time or day. If calling isn’t convenient, you can request a call-back and we’ll be in touch within three working days.

Important things you need to know

-

Legal info

*If you don’t make at least your minimum payment on time each month, or if you go over your business credit limit, you’ll immediately lose any promotional rates you have. If you do lose your promotional rate, or when your promotional rate ends, we’ll transfer promotional balances to your standard balance, or cash balance if they relate to cash transactions.

†Up to 56 days’ interest-free credit on business purchases. If you do not pay your balance in full, you will pay interest on the outstanding balance in line with the standard terms and conditions.

ΔStandard cashback T&Cs apply. The maximum amount of cashback you can earn in any cashback year is £400. 0.5% cashback applies to eligible purchases that you or an additional cardholder makes. This excludes purchases that are returned or refunded, balance transfers, cash withdrawals, cheque purchases, insurance premiums, interest, default charges and other fees and charges.

**Insurance T&Cs apply. If you opt out of insurance, you won’t be eligible for the insurance benefits and won’t be able to make a claim. If you’d like to opt back in, please call us on 0800 008 008 and we’d be happy to help. We’re open 24 hours a day, seven days a week.

††Available on iOS and Android devices only. T&Cs apply.

-

Minimum repayment

You must pay at least the minimum payment every month. This could be:

• £5 every month or the full balance if less than £5

• An amount equal to any interest, default fees or account fees that have been added to your account since your last statement, plus 1% of the remaining statement balance.Remember, if you only make your minimum repayment each month it’ll take you longer and cost you more to clear your balance. But we’ll never ask you to pay more than you can afford. If you want to talk about your finances, call us on 0800 008 008 and we’d be happy to help. We’re open 24 hours a day, seven days a week.

-

Default fees

If you’ve made a late payment, gone over your limit or have a returned payment, you’ll be charged £12. You can avoid paying these fees by staying within your credit limit and making sure you schedule your monthly payments via Direct Debit.