Understanding your account statement

A closer look at statements

This page gives you a step-by-step guide to understanding your gross account statement. Here, you’ll find every detail explained to help you manage your accounts easily. Scroll on or use these quick links to jump to a specific section, or check out our statement FAQs.

Your payment summary in detail:

Your statement in detail:

Your payment summary in detail

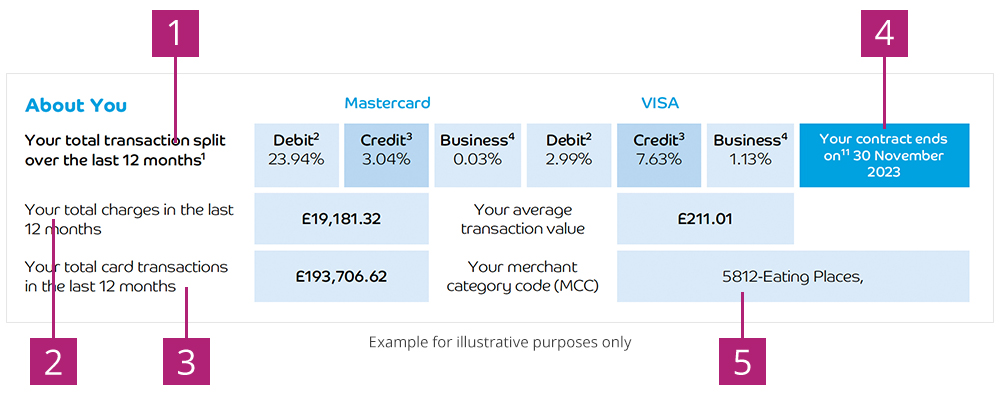

Your card payments summary

Your card payments summary is produced at the same time as your statement.

If you’re a multi-currency customer, meaning you’re billed or settled in a currency that isn’t GBP (Great British Pounds), then we convert those values into GBP for you. This is just to make it easy for you to see how they compare and doesn’t mean the currency of your billing or settlement will change.

Transactions you’ve put through

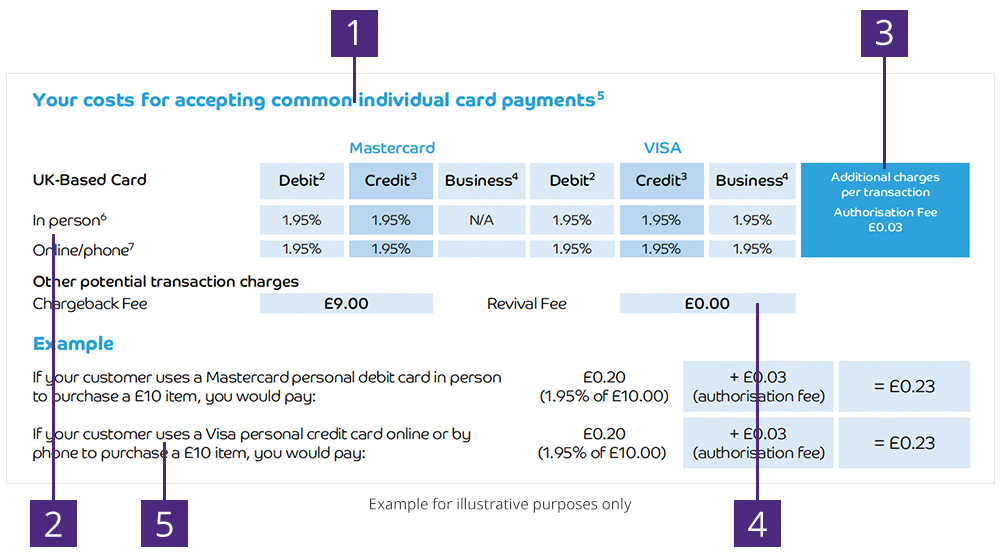

Your costs for accepting card payments

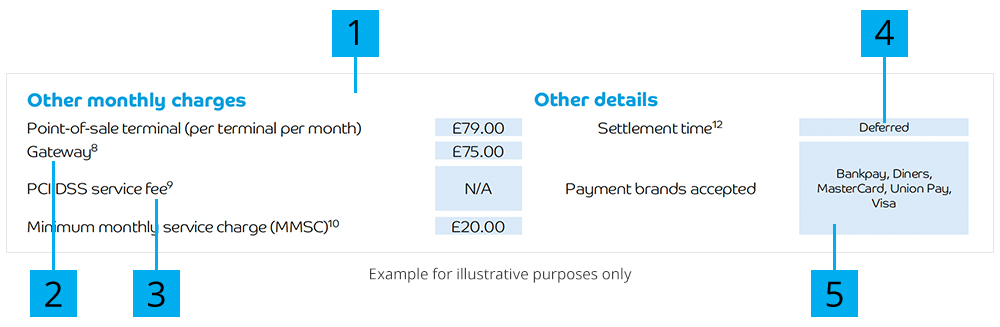

Other monthly charges and details

Your statement in detail

Monthly charges

Charges listed in this section of your statement include the monthly cost of card reader rental, minimum billing fees and other regular merchant service fees. The most common are…

Minimum Billing Charge

This is when we set a minimum transaction charge for each month. If all of your card transaction charges for the month come to less than your minimum billing amount, we’ll charge you the difference.

For example, if your minimum billing amount is £20:

|

Month 1 |

Month 2 |

|---|---|

|

You take £1,000 of card sales, charged at 1.5% |

You take £1,500 of card sales charged at 1.5% |

|

Total card transaction charges = £15 |

Total card transaction charges = £22.50 |

|

Your charges come below the £20 threshold, so we take a £5 minimum billing charge to bring the total to £20. |

Charges are above £20, so there’ll be no minimum billing charge. |

Terminal rental fees

These may appear on your statement as ‘Terminal Rental’, or you may just see the name/model of card reader you’re renting, for example PDQ Classic, or PDQ Mobile.

eCommerce Charges

These only apply to customers using our online payment gateways. For example, Smartpay I (ePDQ), Smartpay A or Smartpay B.

Merchant Security Programme

This is the monthly charge for Data Security Manager - a tool we provide to help you manage your PCI DSS compliance.

PCI Fee

The charge for using one of our products to report your PCI compliance. You can find out more about PCI DSS here.

Transaction charges

These are the fees we charge for processing sales and refunds. Here they are broken down by type. For example, you could see…

|

Charge type |

Value |

Rate per transaction |

Count |

Total |

|---|---|---|---|---|

|

VISA Consumer Debit |

£107.12 |

0.9% & £0.01 |

8 |

£1.04 |

|

VISA Consumer Debit Refund Ppt |

£15.05 |

£0.30 |

1 |

£0.30 |

Table explanation:

There are other charges for different types of transactions, for example:

ePDQ transaction charges

This only applies to customers who use our online payment gateway, ePDQ.

Unapproved transaction

If you take a payment on a type of card our systems don’t recognise, then it will be charged at our agreed default rate. This will appear on your statement as ‘Unapproved transaction’.

Activity based charges

These are charges linked to activity on your account, including authorisations, chargeback and retrieval fees, and more.

Non-secure transaction charge

Non-secure payments are higher risk, so we may charge you an extra percentage of the transaction value. They will appear on your statement as ‘Non-Qual’, or ‘Non-Qualifying’. Types of non-secure payments include:

Chargeback fees

These might appear on your statement as Retrieval Fee or Chargeback Administration Fee. Chargebacks happen when a payment you receive is later disputed by the cardholder or issuer, and we get asked to explain the transaction (see our chargebacks page for more info). If you need to investigate or dispute a chargeback, please contact us.

Card Not Present (CNP) Fee

This fee will be added to your standard Merchant Service Charge (MSC) rate for all Card Not Present (CNP) sales and refunds.

Electronic authorisations

This fee’s normally charged every time your card machine requests authorisation from our servers.

International transaction fee

The charge is added to your standard MSC rate if you take a transaction and the card used is issued outside of the European Economic Area.

Voice authorisations

Occasionally you might need to use our telephone service to get an authorisation for a card transaction. This can happen if for some reason you can’t authorise it electronically, or if your card reader instructs you to call us. There’s a fee for using this service.

VAT adjustments

An adjustment of VAT on your account.

All other charges

There are other charges that may occasionally appear on your statement. If you need an explanation of these, please get in touch.

If you lease your terminal through any other business, then you’ll need to contact them if you wish to close your account as fees may apply. You can talk to us about this or about your statement by calling 0800 161 5343 between Monday to Friday, 9am – 6pm.